If you're a small-to-midsize CPG brand on Amazon's Vendor Central, the support infrastructure you relied on is gone, and it's not coming back. The 2P retail operator model is the fastest path to stable operations for brands navigating this transition: one partner who purchases your inventory, becomes the seller of record, and runs the channel with their own capital on the line.

Here's what happened, why the usual alternatives make it worse, and what actually works.

Amazon announced 14,000 corporate layoffs in October 2025, the largest in company history. CEO Andy Jassy is "flattening" the organization, cutting middle management by at least 15%.

The headlines talk about AI automation and efficiency. But here's what they're missing: retail managers supporting 1P vendors are getting hit hardest.

If you're a small-to-midsize CPG brand doing less than $10M annually through Vendor Central, those Amazon account managers were already unresponsive. Now they're being eliminated entirely.

This isn't just corporate restructuring. It's the final chapter in a story that started in November 2024, when Amazon terminated thousands of small vendor accounts under $5–10M.

Amazon doesn't want small 1P relationships. They're too resource-intensive, too low-margin, and misaligned with where the company's headed.

What follows is the full picture: what Amazon's 1P exodus means for CPG brands, why the traditional alternatives create more problems than they solve, and how the 2P retail operator model offers a structurally different path forward.

The 1P Purge Pushing Small Brands Out

Layoffs are not new. Amazon started eliminating small vendors months before the layoffs hit. In November 2024, thousands of brands received termination notices from Amazon. If you're generating under $5-10M annually through Vendor Central, you're cut loose. Amazon suggested transitioning to Seller Central (3P) instead.

Timing? Just weeks before Q4 holiday season 2024. Kind of brutal. Amazon called it "strategic realignment" to focus on enterprise-level vendors. Sound familiar?

Translation: small brands consume resources without generating enough profit. The contraction started at $5-10M, but analysts predict it'll climb, potentially affecting brands that can't meet Amazon's new volume thresholds through 2026.

Why Amazon Is Cutting 1P Vendors

The 1P Purge: Small Brands Are Being Systematically Pushed Out

Amazon started eliminating small vendors months before the layoffs hit.

In November 2024, thousands of brands received termination notices from Amazon. If you're generating under $5–10M annually through Vendor Central, you were cut loose. Amazon suggested transitioning to Seller Central (3P) instead.

The timing was deliberate: just weeks before Q4 holiday season 2024.

Amazon called it "strategic realignment" to focus on enterprise-level vendors. Translation: small brands consume resources without generating enough profit. The contraction started at $5–10M but analysts predict it'll climb, potentially affecting brands who can't hit Amazon's new volume thresholds through 2026.

Amazon's new priorities:

Enterprise brands with $20M+ annual sales

Direct supply chain relationships in grocery and CPG categories

Vendors meeting strict cost and compliance demands

The casualties: Brands struggling with Amazon's price control, vendors with lower profitability, anyone who can't provide differentiated products. In other words, most mid-market CPG brands.

Why the Oct 2025 Layoffs Made Everything Worse

Fast forward to October 2025. Amazon announces another 14,000 job cuts, with more anticipated in 2026. These cuts could ultimately reach 30,000 and are expected to save Amazon between $2.1 billion and $3.6 billion annually.

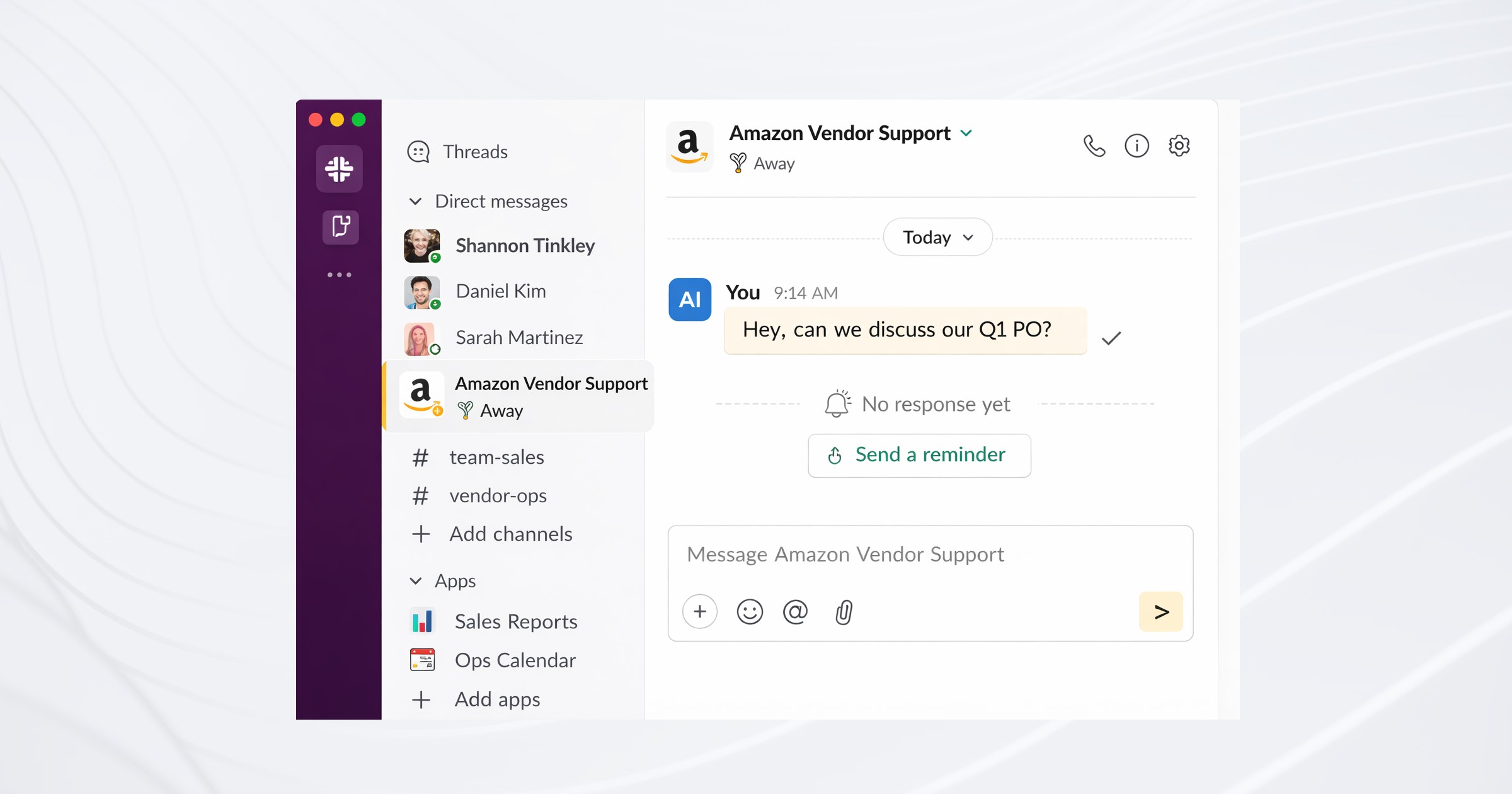

Who's being targeted? Middle management, especially in retail divisions. The very people who historically managed vendor relationships, placed purchase orders, and served as your point of contact inside Amazon.

Amazon CEO Andy Jassy has been explicit about why: "when you add a lot of people, you end up with a lot of middle managers, and those middle managers, though well-intentioned, want to put their fingerprint on everything." His solution? Eliminate the layers. Increase individual contributor ratios. Let AI and automation handle what humans used to do.

For brands still operating in 1P, especially those on the smaller end, this is catastrophic. You were already fighting for attention from overworked account managers. Now those roles are disappearing entirely, replaced by algorithms that prioritize Amazon's largest, most profitable vendors.

The implication is clear: if you're a small brand in 1P, Amazon no longer has the infrastructure to support you. And they're not pretending otherwise.

The False Choice Between 1P Squeeze and 3P Chaos

Amazon's suggestion for squeezed-out vendors: "If you'd like to continue selling our products on Amazon, we welcome you to list your items as an independent seller" in Seller Central (3P).

Here's what that actually means:

You're now responsible for listing optimization, inventory forecasting, FBA logistics, advertising management, customer service, review monitoring, brand protection, pricing strategy, Buy Box optimization, and compliance with Amazon's constantly shifting policies.

All while competing against sellers who've been operating in 3P for years.

The transition from 1P to 3P is an operational overhaul. You're going from Amazon handling fulfillment and logistics to managing everything yourself.

For lean teams, the options are:

Build an in-house Amazon team (expensive, slow)

Hire fragmented agencies (one for ads, one for content, one for logistics)

DIY and burn out

None solve the core problem: you need expertise, infrastructure, and cash flow support, not more vendors to manage.

Why Traditional Agencies Don't Solve the Problem

The instinct is to hire an Amazon agency to manage 3P. But the economics don't align.

Most agencies charge flat monthly retainers ($5K–15K+ monthly) or percentage-based fees regardless of results. You still carry all inventory risk and cash flow burden. They get paid whether products sell or gather dust in FBA warehouses.

Meanwhile, you're coordinating multiple vendors: one for ads, another for creative, a third for logistics. Nothing integrated. Nobody owning the full outcome.

The fundamental misalignment: Forrester has been explicit: the agency-client relationship is structurally broken. Agencies are evolving into vendor-like resellers of tech and media, not accountable partners. They maximize billable hours and retain clients, not your profitability. If your Amazon channel underperforms, they still collect fees.

You've traded the 1P squeeze for 3P chaos at premium prices.

The 2P Alternative

The 2P Alternative: Partnership Over Patchwork

There's a third option that most brands overlook: the 2P retail operator model.

Instead of selling wholesale to Amazon (1P) or managing everything yourself through fragmented vendors (3P), you partner with a retail operator who purchases inventory from you and runs your Amazon business as their own, with their own capital on the line.

At Neato, this is our model:

Upfront inventory purchase. Predictable purchase orders, fast payment. We absorb inventory risk. We only profit when we sell your products.

Full-service execution, zero fees. Strategy, content, Amazon Advertising, demand planning, customer service, review management, brand protection, creative, all included. No retainers. No percentage-of-ad-spend markups. Purchase orders only.

You maintain brand control. You stay involved in strategic decisions. We execute within your guardrails. Your brand positioning, creative direction, pricing strategy remain yours.

Performance-aligned compensation. Our compensation comes from margin on products we purchase and resell. If we don't grow your business profitably, we don't make money. That's not a tagline. It's a structural description of what changes when your commerce partner owns the inventory.

The Cost of Waiting

What Happens to Brands Who Wait

The trend is clear: Vendor Central contraction is unlikely to reverse in 2026. Amazon has prioritized enterprise brands, and mid-market vendors are on borrowed time.

Even if your account hasn't been terminated, the warning signs are everywhere:

Purchase order delays extending 30–60 days (up from 14–21 days in 2023)

Increasing chargebacks as Amazon tightens compliance

Disappearing support as managers get cut

Worse terms, less attention, more friction

Brands that proactively transition (hybrid 1P/3P, full 3P with support, or 2P retail operator partnerships) are locking in better margins (typically 5–15%), controlling brand presence, and building Amazon businesses independent of Amazon's shifting priorities.

The question isn't if you need to evolve your strategy. It's when, and whether you'll move proactively or get forced out with no runway.

Control Your Exit Before Amazon Controls It for You

Amazon's 1P vendor program was never built for mid-market CPG brands. It was built for Amazon.

The equation has changed. Amazon cut small vendors in November 2024 (thousands of accounts under $5–10M terminated) and eliminated 14,000 retail managers in October 2025. They're dismantling the infrastructure that once made 1P viable.

Wait for Amazon to decide, and you'll scramble before Q4.

At Neato, we work exclusively with CPG brands navigating this transition. Brands like TropiClean achieved 95% Buy Box control, 28% listing traffic increases, and 39.3% quarter-over-quarter sales growth while maintaining brand integrity and profitability.

The 2P retail operator model isn't about abandoning Amazon. It's about building an Amazon strategy that works for your brand, with a partner whose revenue depends on making it work.

Amazon's message is clear: adapt or exit. The support system is gone.

Let's talk about 2P before the next round of vendor terminations hits →

What Should 1P Vendors Do When Amazon Cuts Their Account?

Brands dropped from Vendor Central have three options, and only one doesn't require rebuilding from scratch.

The first option is going in-house: build an internal Amazon team, hire 3P specialists, manage Seller Central yourself. It works, but it's expensive, slow, and pulls focus from your core business. The second is hiring agencies, faster to spin up, but structurally misaligned. You're still the seller of record, you still carry all inventory risk, and now you're coordinating multiple vendors who bill regardless of results.

The third option is partnering with a 2P retail operator. A retail operator purchases your inventory at wholesale, becomes the seller of record, and runs the entire channel as their own business: pricing, advertising, content, fulfillment, brand protection. Your involvement: one purchase order and brand oversight. Their involvement: everything else, funded by their own capital.

For brands navigating the 1P-to-3P transition, this is the fastest path to stable operations with aligned incentives across Amazon and every other channel. See how the model works →